The threat of climate change is driving a significant shift in the global energy landscape. Central to this change is the increasing investment in energy transition, a strategic initiative aimed at reshaping our energy systems for sustainability, resilience, and efficiency. The focus is on investing in cleaner, more sustainable energy sources to replace traditional fossil fuels. This investment is vital for fostering economic growth, promoting innovation, and addressing climate risks proactively.

Understanding where these investments are going is essential for supporting the market with experts in power and energy engineering. Our specialists closely monitor market trends to stay informed about the latest developments, challenges, and opportunities associated with new investments.

So, where exactly are the largest global investments directed? Which regions are allocating more funds to new projects, and what types of projects are considered the future of investment? A recent report from BloombergNEF sheds light on the regions committing the most money and the sectors with the greatest potential. Here's our summary of the significant opportunities within the energy market.

Global Numbers

In 2023, investment in energy transition hit a record high of $1.77 trillion, representing a notable 17% surge from the previous year. What's striking is that this global investment in energy transition exceeded spending on fossil fuel supply by a significant $671 billion in the same year. The report examined ten key sectors, including electrified transport, renewable energy, power grids, electrified heat, nuclear energy, clean shipping, hydrogen, CCS (carbon capture and storage), energy storage, and clean industry.

Sectors

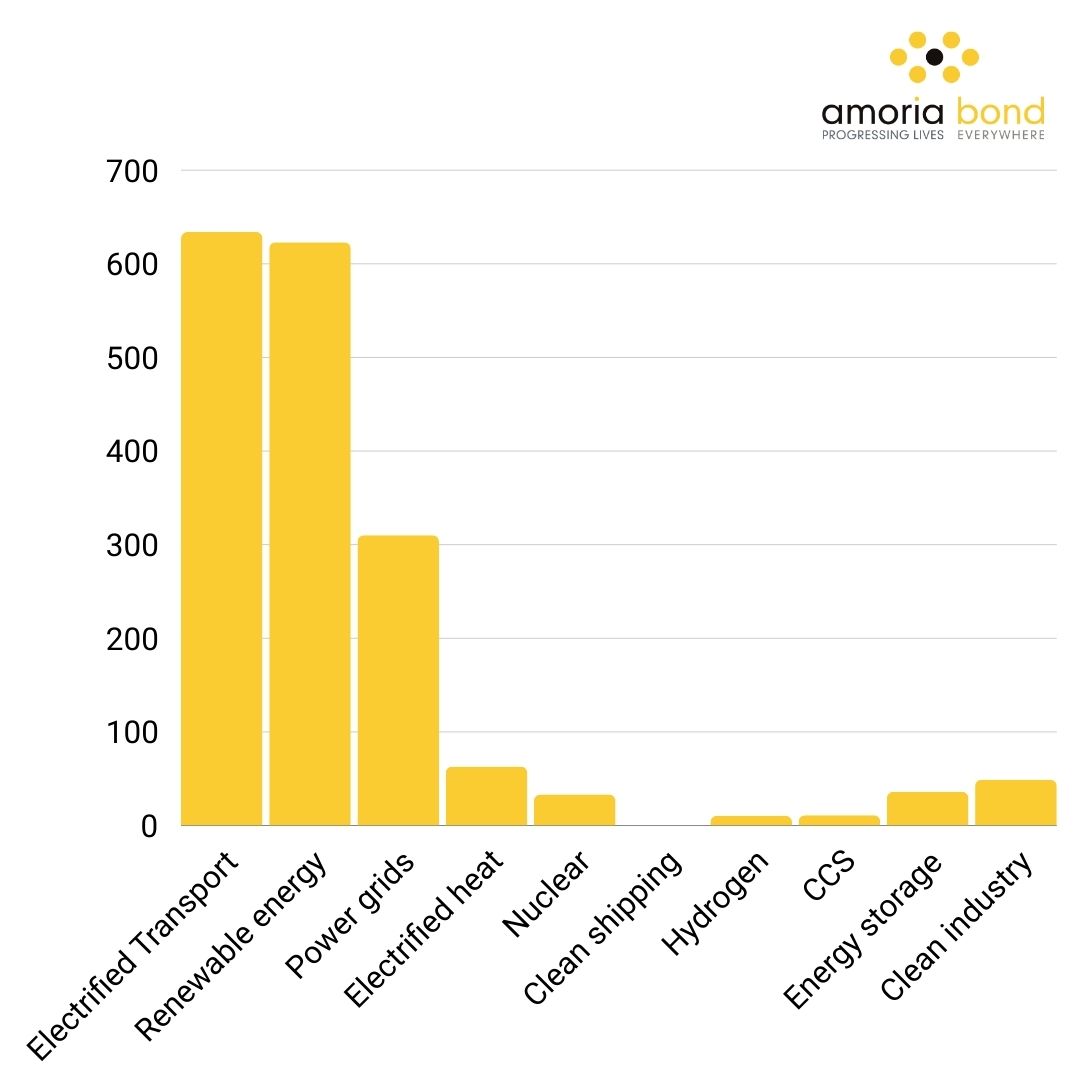

Figure 1: Energy Transition Investments per Sector (Source: BloombergNEF)

Figure 1 reveals that a significant investment of $634 billion in electrified transport underscores the global commitment to sustainable transportation, making it the largest sector of investment in 2023. This marks a notable year-on-year increase of 36%, surpassing investments in renewable energy, which received $623 billion. Power grids secured the third position with an investment of $310 billion, showing steady growth each year. Following sectors are electrified heat and clean industry, which received investments of $63 billion and $49 billion, respectively. Energy storage experienced remarkable growth at 76%, reaching investments of $36 billion. Nuclear energy secured the 7th place with $33 billion of investment. CCS, with $11.1 billion, nearly doubled its investment, ranking 8th. Hydrogen witnessed a substantial increase in investment, reaching $10.4 billion, tripling its previous investment. Clean shipping, with an investment of $385 million, ranked last.

These figures in Figure 1 depict varying levels of popularity among investors for different sectors. Hydrogen, energy storage, and electrified transport were among the favourites in 2023, while nuclear, electrified heat, and clean shipping experienced slight declines.

Countries

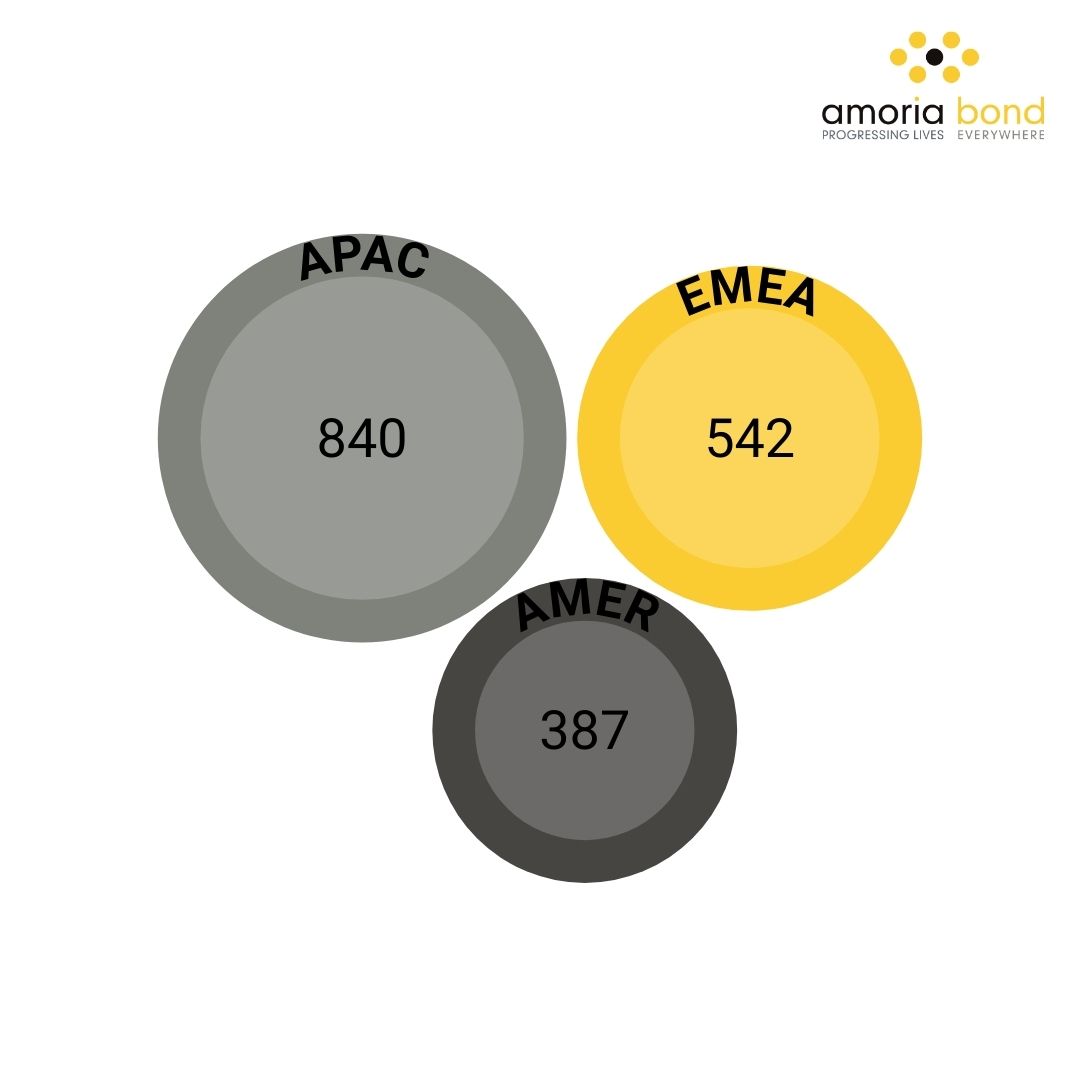

Figure 2: Energy Transition per Region (Source: BloombergNEF)

All regions around the world are heavily prioritising clean energy, driven by concerns over dwindling fossil fuel resources and alarming climate change trends. This heightened focus has led to increased investment across every region. Figure 2 provides a visual representation of the three main regions highlighted in the report: APAC (Asia Pacific), EMEA (Europe, Middle East, and Africa), and AMER (Americas).

APAC stands out as the primary investor in energy transition, while the Americas contribute a substantial $387 billion. However, APAC's investment grew by only 7% due to reduced investment in renewable energy, whereas the Americas experienced a notable 15% increase from the previous year. This growth is attributed to the implementation of the Inflation Reduction Act, one of the largest investments in American history, aimed at bolstering the economy, climate, and energy security.

Despite APAC's leading role as the primary investor, EMEA (Europe, Middle East, and Africa) witnessed the most significant growth at 38%. This growth was fuelled by a robust solar year for Europe and increased investments in electrified transport, CCS, clean industry, and hydrogen.

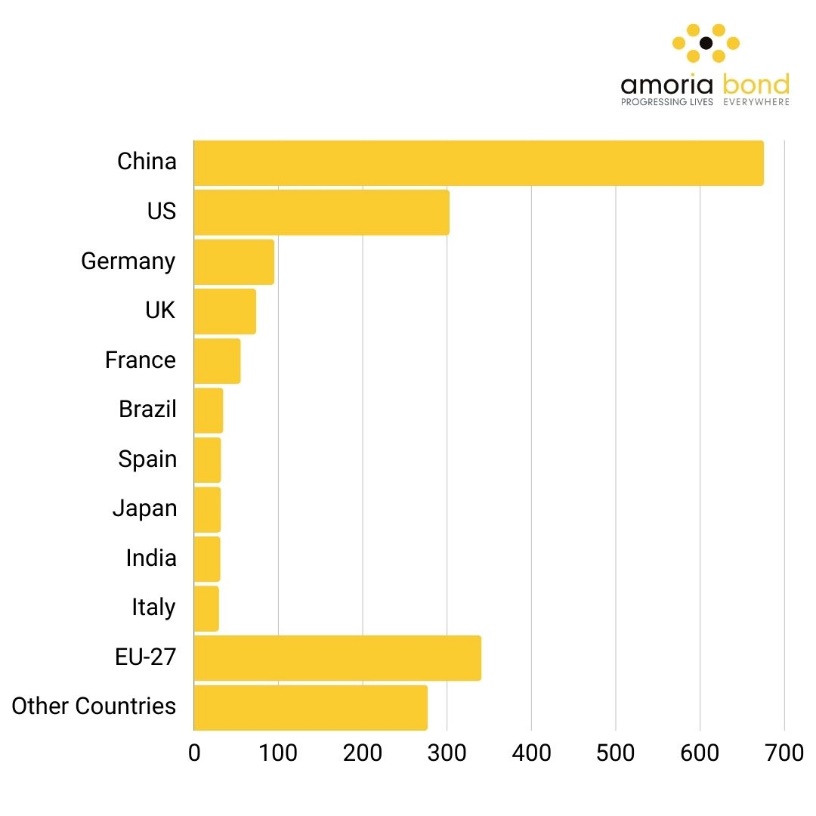

Figure 3: Energy Transition Investments per Country (Source: BloombergNEF)

The third figure illustrates the largest investors in energy transition. China emerges as the top investor, contributing 38% of the global total at $675.9 billion, with a focus on electrified transport, renewable energy, and power grids. The US follows closely as the second-largest investor in these sectors, with $303.1 billion in investments. Germany holds third place on the list, investing $95.4 billion, with a particular emphasis on electrified transportation. Notably, five of the top ten countries are within the European Union, and collectively, all EU countries invest more in energy transition than the US.

What’s Next

Despite the increased investment in energy transition, all regions must ramp up their efforts to align with BNEF’s Paris-aligned Net Zero Scenario, which calls for an average investment of $4.84 trillion per year between 2024 and 2030, which is triple the current investments. This scenario, devised by BNEF, aims to achieve a net-zero emissions world by 2050 and limit global warming to below 2°C. The bulk of these investments should be directed towards electrified transport, renewable energy, and power grids.

The journey towards achieving a net-zero carbon emissions world poses a significant challenge for many energy companies. According to the Bain ENR Transition Survey, the number of executives who believe we will reach net-zero carbon emissions by 2050 has declined. In 2023, 46% of executives held this belief, which dropped to 38% in 2024. The primary challenge of the energy transition lies in achieving a favourable return on investment (ROI), with some companies sceptical about whether consumers will be willing to pay higher prices for clean energy.

In conclusion, while the future appears promising, companies cannot afford to slacken their pace due to the arduous journey ahead. The significant drop in solar and wind power costs between 2010 and 2022, making them cost-competitive with fossil fuels even without financial support, indicates that investment in energy transition is both lucrative and sustainable for energy companies. This contributes to creating a more climate-friendly world.

Why you should work with a specialised energy recruitment company

Many of our clients are currently facing several challenges:

1. Struggling to reach a critical mass of projects, which strains an already-overburdened team.

2. Dealing with significant internal skills gaps, especially when it comes to executing projects of much larger size and complexity.

3. Implementing projects in new locations without access to local expertise.

4. Needing expertise for specific functions or key stages of the project.

All of these challenges carry the risk of impacting project outcomes adversely. A specialised energy recruitment company can assist in addressing these issues by providing customised solutions.

At Amoria Bond we offer 360° solutions, tailored to your needs. From the beginning of the process, we have regular contact with both clients and candidates to give the best service possible. Because we have an extended global talent pool, we can deliver the best energy experts, who can uplift your business by matching their skills and experience with your company’s values, demands and goals.

Progress Your Life with Amoria Bond

Amoria Bond’s specialist team of energy recruitment experts work with skilled candidates, who are an added value for your company. For candidates we offer global career opportunities with growth potential.

To find out about our services or learn how we can help you secure your next renewable energy job, get in touch with our teams today.